ODIGOS CONSULTING FIRM

Institutional Capital & Hospitality Advisory Platform

Lead Advisory Team

Capital Strategy | Hospitality Partnerships | Governance & Execution

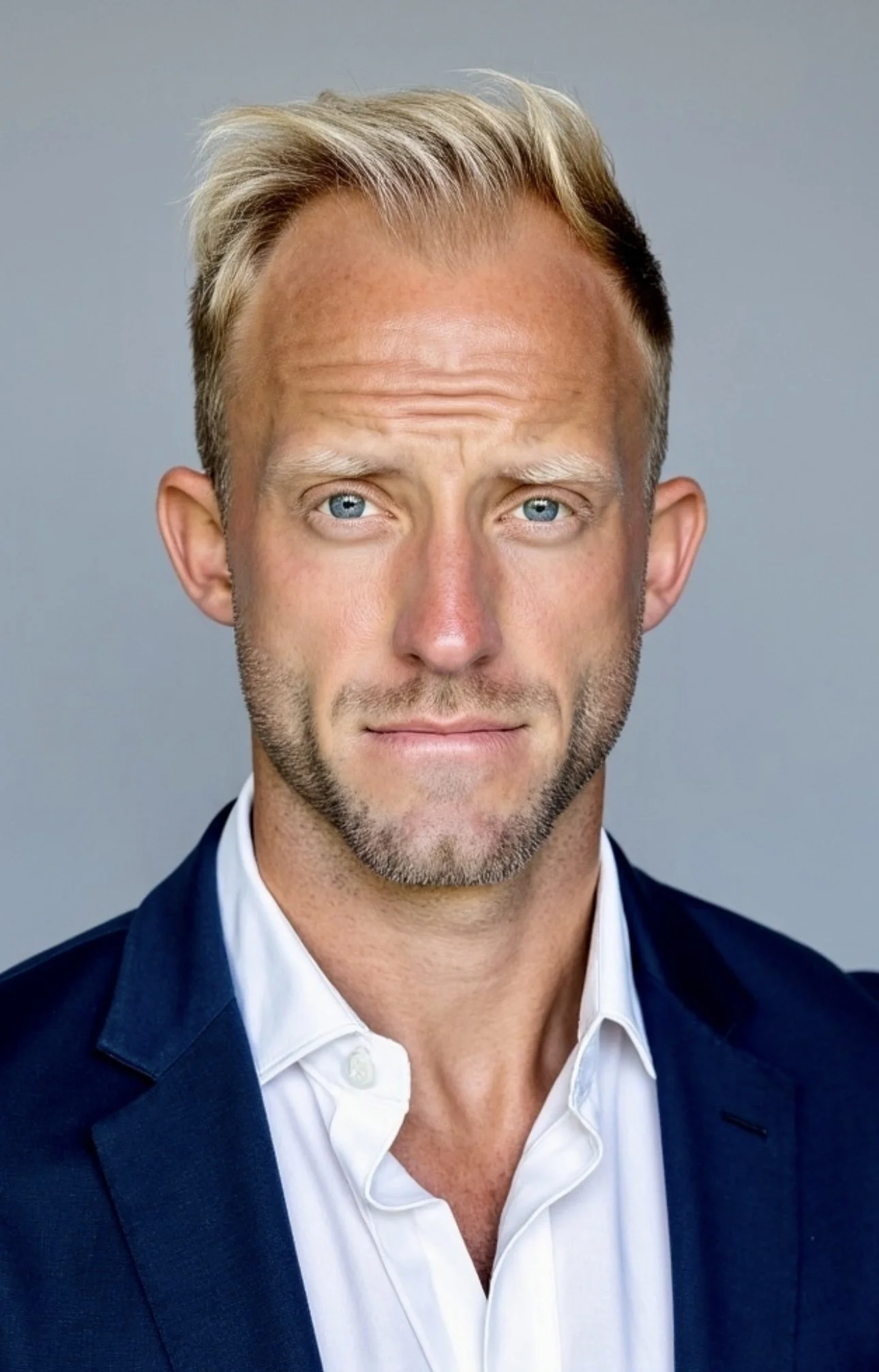

Brady Schultz

Founder, Odigos Consulting Firm | Capital Strategy & Transaction Architect

Brady Schultz is the Founder of Odigos Consulting Firm, an advisory platform operating at the intersection of institutional capital, structured finance, and strategic partnerships across real assets, technology, and enterprise platforms.

He specializes in transaction architecture and capital alignment for complex, multi-party transactions involving:

Private equity and private credit

Strategic corporate partnerships

Venture and growth capital

Public-sector and government-linked financing

Hospitality, energy, and emerging technology platforms

Brady’s work centers on translating sponsor vision into IC-ready capital structures—balancing control, risk allocation, governance, and long-term value creation. Through Odigos, he has advised ownership groups, operators, and investors on capital stack design, JV structuring, institutional positioning, and execution oversight from LOI through closing and scale.

Advisory Platform

Odigos Consulting Firm

Odigos operates as a lead advisory platform for high-value, complex transactions across hospitality, real assets, technology, and institutional partnerships.

Core Capabilities

Capital Architecture

Senior debt, private credit, preferred equity, GP/LP and hybrid structuresStrategic Partnerships

Brand/operator alignment, corporate JVs, platform-level alliancesInstitutional Positioning

Investment committee materials, valuation frameworks, capital narrativesExecution Oversight

Process management from LOI through definitive agreements and capital closePublic & Strategic Capital

Government programs, infrastructure-linked funding, enterprise partnerships

Richard Schaeffer-Onsurez

Senior Hospitality Executive | Global Partnerships & Strategy | Board-Level Advisor

Richard Schaeffer-Onsurez is a senior hospitality executive and board-level advisor with more than a decade of experience guiding hotel partnerships, brand strategy, and portfolio expansion across luxury and lifestyle hospitality platforms.

He has advised and led strategic hotel partnerships for sbe and the SLS Hotel Group, playing a pivotal role in the development and openings of SLS Hotel Las Vegas and SLS Hotel Miami. His work also includes collaboration on the SLS Tribute Hotel partnership with W Hotels, aligning ownership, brand, and operator interests to maximize long-term asset and platform value.

For over 10 years, Richard led the Hotel Partnership Division at Hilton Grand Vacations, where he partnered with developers and ownership groups to expand Hilton’s hotel partnership portfolio by 50%+. His mandate focused on timeshare-integrated hotel platforms, brand alignment, governance frameworks, and scaling partnerships across complex ownership and capital structures.

He currently serves as Head of Partnerships & Strategy (Global Inventory) and Co-Chair of Corporate Sustainability Initiatives, advising leadership teams on portfolio strategy, ESG alignment, and long-term platform growth.

Combined Value Proposition

Where Capital, Brand, and Execution Converge

Together, Odigos and its hospitality leadership team provide a rare integration of institutional capital strategy and operator-level hospitality expertise. This enables sponsors and landowners to move beyond transactional financing toward platform-level value creation, aligning ownership, capital, brand, and long-term strategy within a single, coordinated advisory framework

Advisory Platform

Odigos Consulting Firm

Odigos operates as a lead advisory platform for high-value, complex transactions across hospitality, real assets, technology, and institutional partnerships.

Core Capabilities

Capital Architecture

Senior debt, private credit, preferred equity, GP/LP and hybrid structuresStrategic Partnerships

Brand/operator alignment, corporate JVs, platform-level alliancesInstitutional Positioning

Investment committee materials, valuation frameworks, capital narrativesExecution Oversight

Process management from LOI through definitive agreements and capital closePublic & Strategic Capital

Government programs, infrastructure-linked funding, enterprise partnerships

Network & Reach

Our advisory platform connects private equity, private credit, family offices, global hospitality brands, institutional lenders, strategic corporates, and public-sector capital partners, providing sponsors with direct access to decision-makers across capital, operations, and governance.